Is Temu Safe to Use Credit Cards? Are you considering using your credit card on Temu but feeling unsure about its safety?

With the rise of online shopping, it’s crucial to know whether platforms like Temu offer secure transactions. Temu, an emerging online marketplace, has sparked debates around its credit card security. It’s natural to question the safety of your financial information, especially with mixed reviews and reports of credit card fraud linked to the app.

In this article, we’ll delve into the heart of your concerns: Is Temu safe to use with a credit card? We’ll explore Temu’s security measures, including SSL encryption, PCI certification, and partnerships with major payment providers.

But we won’t stop there.

We’ll also examine the controversies and customer experiences that have raised eyebrows.

By the end of this article, you’ll have a clearer understanding of the risks and protections involved when using your credit card on Temu. Stay tuned to make an informed decision about your online shopping security.

What is Temu?

Temu is an online marketplace app that offers a wide range of products at competitive prices. It is known for its extensive selection, which includes categories like fashion, home goods, electronics, beauty products, and more.

The app is designed to provide a convenient and efficient shopping experience for users, often featuring great deals and discounts on various items.

Temu’s business model typically involves sourcing products from a global network of suppliers, allowing them to offer a diverse range of products at lower prices compared to traditional retail outlets. The app is generally user-friendly, with features that make it easy to browse, search, and purchase products and track and manage orders.

With a grand entrance into the U.S. market in September 2022, Temu positioned itself as one of the most popular discount online retailers, vowing to revolutionize the landscape of online shopping with its affordability and speed.

Temu is a subsidiary of PDD Holdings, a Chinese e-commerce company based in Ireland. Temu, the Boston, Massachusetts-based platform swiftly expanded its reach to 47 global markets, including the UK, Canada, Australia, Israel, and Japan.

Despite its divisive reception and controversy, Temu has achieved remarkable success, surpassing industry giants like Amazon, Walmart, and Shein to become the top free shopping app on both Google Play and Apple with 100M+ downloads and a whopping $1 billion annual revenue by December 2023.

Temu’s Reputation and Controversies

Temu’s ascent has not been without its fair share of controversies and rumors. As it competes with industry behemoths like Amazon and Walmart, several narratives surround the platform:

- Data Security Concerns

Temu faces scrutiny for the data it collects and its Chinese parent company, PDD Holdings. Allegations of the app functioning as spyware rather than a shopping platform have surfaced. Claims of banking information being sold on the black market or leaked after using Temu have raised red flags.

According to Politico, Apple has accused Temu of breaching privacy regulations and providing false information about its data usage. Temu’s privacy nutrition labels were said to be misleading and it does not give users the option to opt out of internet tracking. The app is available in the App Store after resolving this issue.

Recently, a group of consumers has filed a class action lawsuit in Illinois federal court against Temu. The consumers allege that Temu collects excessive user data without proper disclosure. - Controversial Stories

Various stories circulate about Temu, including accusations of collecting data for Communist China, the suspension of its sister site Pinduoduo by Google due to malware, and legal battles with Shein over intellectual property infringement. - Product Quality and Availability

Some influencers have expressed concerns about identity theft, orders not arriving, and the quality of received goods.

Who owns Temu?

TEMU operates under the ownership of PDD Holdings, a corporation with public listings on the NASDAQ stock exchange.

As a consequence of their status as a publicly traded entity, they are subjected to stringent regulatory oversight. This necessitates a high degree of transparency in their financial reporting and operational disclosures, ensuring that shareholders and regulators are provided with a clear and accurate representation of the company’s fiscal health and business practices.

The regulatory framework for public companies ensures that all material information that could influence investment decisions is fully accessible to the investing public.

As a subsidiary of PDD Holdings, Temu represents a minor segment of its parent company’s expansive portfolio. PDD Holdings reported a substantial revenue generation of $19 billion in 2022 and $14.5 billion in 2021.

Temu Security Measures

Temu, like many online platforms, likely employs a variety of security measures to protect its users’ data and ensure a safe shopping experience. The common practices in e-commerce security that Temu uses include:

SSL Encryption

Temu app and website use SSL encryption as a major part of its security process.

SSL is crucial for secure online payments as it encrypts data between the user and the server, ensuring that sensitive information like credit card details remains private.

It also authenticates the server’s identity, safeguarding against impersonation by malicious entities. Additionally, SSL maintains data integrity, preventing unauthorized alterations,

No Credit Card Data Retention

TEMU ensures your credit and debit card details are processed exclusively by payment processors, never residing on their servers. This approach eliminates the risk of your card information being compromised during a data breach

PCI certification

All payment links of Temu have PcI certifications. PCI (Payment Card Industry) certification plays a crucial role in securing credit card payments by ensuring that companies adhere to rigorous security standards. These standards include:

- Data Protection: PCI standards require that sensitive cardholder data is encrypted and stored securely, reducing the risk of data breaches.

- System Security: Companies must maintain secure networks and systems to protect payment data from unauthorized access.

- Regular Monitoring: Regular testing and monitoring of networks ensure ongoing protection against new vulnerabilities and threats.

- Compliance Audits: Regular audits verify compliance, ensuring Temu maintains high-security standards continuously.

Overall, PCI certification plays a vital role in maintaining the integrity and security of credit card transactions in Temu.

Sign In Activity

Temu app supports a “sign-in activity” option that specifies details about all the logging-in sessions on your account. These details include the device type, date, and time of singing. You should periodically check this option in the settings and sign out from any unknown device.

Temu Security Response Center

The Temu Security Response Center (TemuSRC) is a specialized platform for identifying and addressing security vulnerabilities to protect Temu users, businesses, and products.

It facilitates cooperation with security experts. Security researchers are invited to report any security concerns to TemuSRC, contributing to the enhancement of Temu’s product security. Prompt action is taken to resolve reported issues.

Temu has also partnered with cybersecurity expert HackerOne to fully protect the security of Temu’s users, businesses, and products.

It’s worth noting that TEMU has also won preliminary court injunctions against phishing websites that were impersonating the platform.

Major Payment Providers

Temu accepts payments from a diverse array of 15 different payment providers.

The established payment providers in Temu, such as PayPal, Visa, Mastercard, American Express, and Discover, bolster user confidence with their globally recognized security measures.

For instance, options like PayPal and Venmo appeal to users who prefer not to enter credit card details online, offering a layer of separation between their bank accounts and online merchants

At the same time, credit card giants like Visa and Mastercard offer their own layers of security protocols, such as secure tokenization and real-time fraud monitoring. American Express and Discover are also known for their rigorous card member protection services.

These companies protect against unauthorized transactions and provide a safety net through their customer service and dispute resolution processes. For instance, if a transaction goes awry, platforms like PayPal and credit card services offer avenues to contest chargeback and secure refunds.

This comprehensive security infrastructure provided by such reputable entities plays a pivotal role in assuring Temu users that their credit card payments are in safe hands. They would likely reassess their partnership with Temu if their standards for security and customer protection were compromised.

Temu Security certifications

Temu’s array of security certifications showcases its commitment to safeguarding customer transactions and data:

- PCI DSS: This is a set of requirements designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment. It’s a global standard and is one of the most important certifications for online retailers.

- VISA Secure: Formerly known as Verified by Visa, this program provides an additional layer of security for online shopping. It often requires the cardholder to enter a password or a code sent via SMS when making a purchase, thus verifying the user’s identity.

- ID Check: This refers to services that verify the identity of the cardholder during online transactions, adding another level of fraud protection.

- American Express SafeKey: Like VISA Secure, American Express SafeKey uses a similar approach for its cardholders, employing a 3D Secure technology for online purchases to prevent unauthorized use.

- Mastercard SecureCode (ProtectBuy): This is Mastercard’s private code for online shopping, providing enhanced security by requiring a secret code known only to the cardholder and the financial institution.

- JCB J/Secure: This is the security program from Japan Credit Bureau, which also uses 3D Secure technology to protect online transactions, similar to the protocols used by Visa and Mastercard.

- TrustedSite Certified Secure: This certification indicates that a website has been tested and passed the TrustedSite security scan, which checks for malware, viruses, and other vulnerabilities that could harm users.

By acquiring these certifications, Temu demonstrates its proactive stance in implementing comprehensive, multilayered security measures. This not only protects your credit card against various types of fraud and data breaches but also boosts consumer confidence in the platform’s reliability and safety.

Email Verification

When signing up for TEMU, users must verify their email address, a step that helps prevent the creation of fake accounts that could be used for harmful activities.

Two-factor authentication (2FA)

Recent developments in Temu’s security infrastructure have addressed a major concern previously highlighted by cybersecurity experts. Initially, Temu’s authentication process was limited to just the standard username and password combination.

This approach, while fundamental, had been deemed insufficient in the evolving landscape of cyber threats, where more robust measures are increasingly becoming a necessity.

Recognizing the importance of enhanced security, Temu has now implemented Two-Factor Authentication (2FA). This significant upgrade marks a pivotal step in bolstering the platform’s defense against unauthorized access and potential security breaches.

2FA adds an essential layer of protection, requiring not only the traditional username and password but also a second factor — typically something only the user has access to, like a mobile device or a security token.

This ensures that even if a user’s password is compromised, the chances of an unauthorized entity gaining access to their account are significantly reduced.

User Privacy and Data Protection on Temu

We analyzed Temu’s privacy policy to discover how Temu handles user data and what exactly the data it collects. Here are some key points regarding the safety of using your credit card in Temu:

- Data Collection and Use: Temu collects personal information, including account and profile details, purchase and payment information, customer support interactions, and user-generated content. This is common practice for e-commerce platforms to facilitate transactions and improve their services.

- Third-Party Sharing: The policy states that personal information is shared with affiliates, service providers, payment processors, advertising and analytics partners, and other designated third parties. This is typical for online businesses, especially for payment processing and marketing purposes.

- Data Security Measures: Temu indicates that it uses technical and administrative measures to protect personal information and follows the Payment Card Industry Data Security Standard (PCI-DSS) for handling credit card information. PCI-DSS compliance is a strong indicator of secure credit card processing practices.

- Retention and Transfer of Data: Personal data is retained to fulfill the purposes for which it was collected and to satisfy legal requirements. Data is stored in the infrastructure of cloud service providers like Microsoft Azure, primarily in the U.S. Sensitive personal information unrelated to fulfillment services is not transferred internationally.

- User Controls and Choices: Users have rights to access, delete, and correct their personal information. There are also options to opt out of marketing communications and manage cookie settings.

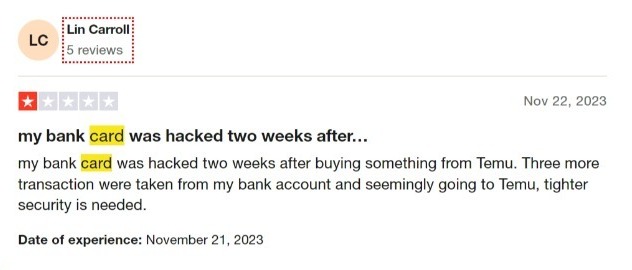

Customer Reviews and Feedback

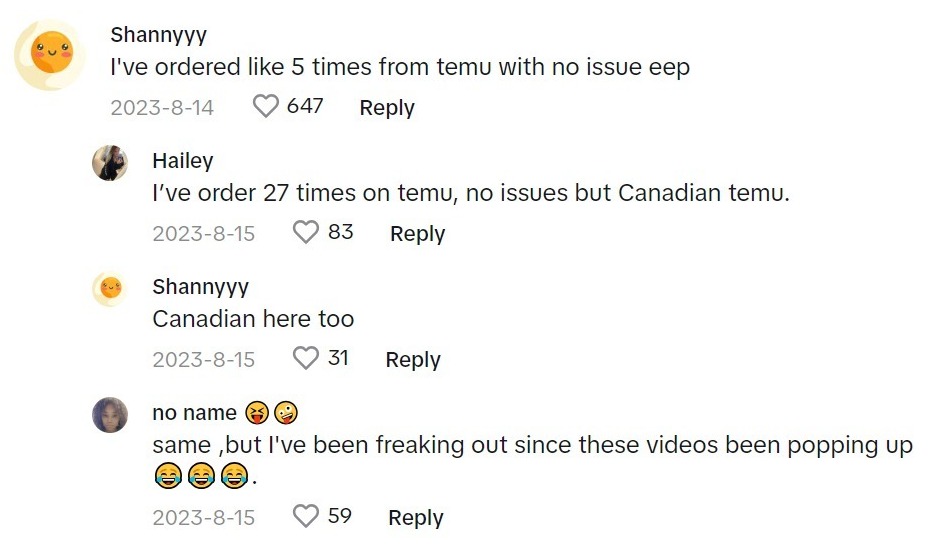

Unfortunately, there are mixed reviews about using credit cards on Temu. Some people say they’ve had problems like stolen card details or unexpected charges after shopping in Temu. But many customers say they’ve shopped without any trouble.

It’s hard to tell if the bad stories are the whole picture or if they just get more attention than the good ones.

Yet, Temu needs to look into these issues and clear things up for their shoppers and for you to take all the needed precautions when buying from Temu.

It’s worth noting that with Temu’s links to China, any data privacy issue gets extra attention, sometimes leading to quick accusations, like calling the app spyware.

It’s smart to look at all these positive or negative opinions with skepticism and remember there’s a whole mix of competition and politics in play that could be influencing what people are saying online.

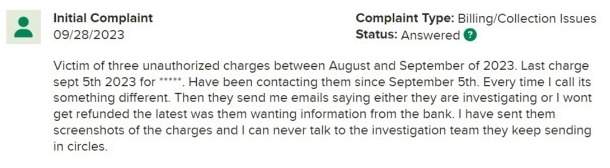

Third-Party reviews on Temu Security

TEMU’s website features trust badges from Norton and Trustpilot, offering users extra assurance. The Norton Secured badge means TEMU has the right encryption and security measures in place.

Meanwhile, Trustpilot’s Average rating shows adequate customer trust and satisfaction. These badges, given by well-known third parties, serve as a stamp of approval for TEMU’s commitment to safety and reliability.

However, Temu has a C+ rating on Better Business Bureau (BBB) with an average customer review rating of 2.53 out of 5 stars. 38 of a total of 1289 complaints are related to billing and collection issues.

How to buy safely in Temu?

Although TEMU takes necessary steps to ensure security, there are plenty of doubts that these steps are not sufficient enough. So It’s equally important for customers to practice safe online shopping habits if they want to use Temu.

- Use third-party payment providers and wallets like Paypal, Apple Pay, or Cash APP or any Buy Now, Pay Later option like Klarna and Afterpay upon ordering from the Temu website or application. Another valid option is to use Vanilla Visa gift cards as an alternative to credit cards or debit cards. This is a MUST.

- Activate Two-Factor Authentication: Adding this extra layer of security to your credit card account can significantly boost protection if you insist on using your credit card.

- Strong, Unique Passwords: Use distinct, robust passwords for your TEMU and payment accounts, and avoid repeating passwords across different sites.

- Look for Secure Browsing Signs: Ensure TEMU’s website has a padlock icon and ‘HTTPS’ in the address bar for secure browsing.

- Regularly Monitor Card Statements: Keep an eye on your statements for any unfamiliar charges and report any unauthorized transactions immediately.

- Avoid Public Wi-Fi for Payments: Use personal devices over secure networks for shopping, rather than public Wi-Fi or shared computers.

- Aside from Temu, it’s advisable to use an RFID blocking card holder to protect your credit cards and debit card data from breach.

- Check Seller Credentials: On TEMU, verify the seller’s ratings and reviews before purchasing to confirm their reliability.

See Also: How to remove credit card from Temu?

What are the steps to take if you suspect credit card fraud in Temu?

If you suspect credit card fraud or credit card charge on Temu that you don’t know about, you should take the following steps:

- Notify your bank or credit card company: Contact your bank or credit card provider immediately to report the suspected fraud and dispute any unauthorized charges.

- Turn on transaction notifications: Enable transaction notifications on your credit cards and bank accounts to stay informed about any activity on your accounts.

- Place a fraud alert: Consider placing a fraud alert on your credit report to alert creditors to verify your identity before extending credit in your name.

- Change passwords: If you suspect that your account on Temu has been compromised, change your password on the platform and any other accounts where you use the same password.

- Monitor your statements: Keep a close eye on your credit card and bank statements for any unauthorized charges or suspicious activity.

- Report the fraud: File a detailed complaint with the Federal Trade Commission (FTC), the FBI, the Internet Crime Complaint Center (IC3), and the Better Business Bureau (BBB) to report the fraud and seek assistance in investigating the matter.

- Remove compromised payment methods: If your payment methods were compromised, remove them from your Temu account and any other affected accounts to prevent future unauthorized charges.

Remember that acting swiftly is crucial in minimizing the impact of credit card fraud. By taking these steps, you can protect yourself and increase the chances of recovering any losses due to fraudulent activity.

See Also: How to unlink PayPal account on Temu?

Verdict: Is Temu Safe to Use Credit Card?

Based on customer reviews and reports, there are significant concerns about the safety of Temu, particularly regarding the use of credit card information. The company has received numerous complaints, including reports of undelivered products, unauthorized charges, and unresponsive customer service. Some users have also raised issues about the security of their financial data, with multiple reports of banking or credit card information being sold or leaked after use on Temu.

While Temu is legit and uses industry-standard encryption, PCI compliance, and tokenization to protect user data, the abundance of complaints and reports raises doubts about the safety of using credit cards on the platform and suggests that their security measures are not enough yet.

It is advisable to exercise caution and consider alternatives like the PayPal payment method or prepaid virtual cards when making purchases on Temu.

Hello! I’m Mohamed Saied, a pharmacist by trade and a dedicated bargain hunter on Temu. My journey into the world of incredible deals and budget-friendly shopping on Temu has been nothing short of exciting, and I’m here to share that excitement with you.